Did you know that once you deposit your currency into a bank, it is no longer yours?

When you make a deposit in to a bank, you are actually lending your savings to them and you are now a creditor of the bank.

The banks now own your savings and agree to pay you a fee for this loan, an interest fee typically around 0.01% currently (2020) but actually zero and even negative in many European countries, so you could now be lending the bank your savings AND paying them to borrow it….

Things are getting a little crazy.

HM Treasury – Gov.UK website

Even though you have now lent your savings to the bank and they legally own it, you do retain a claim to it, and the banks obviously allow you to withdraw the funds, which you would do every day when you buy something. However, if you attempt to withdraw too much in one go, you may come across some problems. £10,000 in the UK is generally a flag point for the banks, and you may get a phone call if you try to transfer more than this. You may also find you have problems withdrawing a large amount of cash from the counter at the bank because banks generally don’t hold much cash. There are also limits on foreign exchange amounts, as this could be seen as money laundering under the KYC (Know Your Customer) and AML (anti-money laundering) laws, which apply to everyone. Except the banks themselves, obviously, who regularly launder billions as seen here. (Do as we say, not as we do).

Now that you are aware that your savings are not actually yours anymore, you might be wondering why this matters. You’ve been using your bank without any problems for years, so why should you care?

After the 2008 financial crisis caused by banks lending to people who couldn’t afford to pay back the loans, which eventually caused a massive implosion of the financial markets, it cost approx. $2.8 Trillion ($2,800,000,000,000) to save the banks that caused the problem in the first place. This required the taxpayer to bailout the banks. As always, the banks make billions gambling with your savings, but when it goes bad, you are expected to pay for it so they can carry on doing it, which they have, and the global debt has increased exponentially since 2008. This is due to Moral Hazard caused by government interference in the free market.

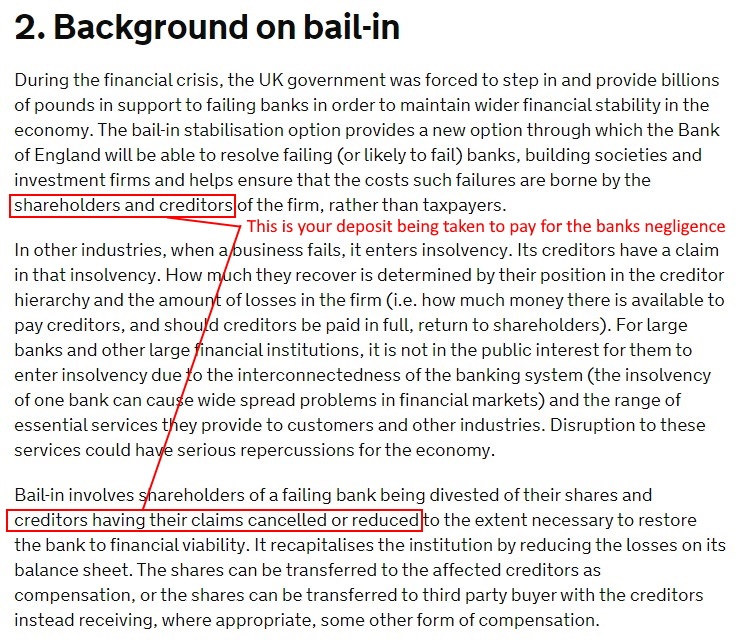

Knowing the taxpayers wouldn’t accept a second bank bailout, the banking regulations were changed so that when the banks failed again (due to Moral Hazard), there would this time be a Bail-in. A bail-in is where shareholders in the banks, such as you and me (if we were to buy shares in it), would be expected to pay towards the losses; basically, your shares would become worthless and you would lose all your ‘money’, although you may be offered some worthless shares in the new bank as a consolation prize. The bank’s creditors would also bail out the bank, so they would also lose their savings.

There are insurances such as the FSCS in the UK which will insure deposits up to £85,000 or the FDIC in the US which should insure deposits up to $250,000 (you will lose any amount above these) and these insurances will pay out should your bank require a bail-in, however it’s widely stated that the insurances only have the funds to cover less than 1% of all banking deposits at any given time, so hopefully not too many banks will fail at the same time or there won’t be enough insurance to cover everyone’s deposits.

If you believe the banks are honest and reliable and you don’t think they would do anything as reckless again as they did prior to 2008 to cause the last financial crisis, then all of this won’t be a concern. Maybe you’re not worried about the global debt increasing from around $150 trillion in 2008 to over $300 trillion in 2022, which is approximately $37,970 for each of the 7.9 billion people on Earth. In which case you’ll be able to sleep easy, trusting your savings to the banks.

Or maybe you think now might be a good time to start protecting some of your savings with Gold.